Non-Resident Indians (NRI) must follow the rules and regulations laid out by the Foreign Exchange Management Act (FEMA) and the RBI rules.

Category: NRI Personal Finance

Linking Aadhaar-PAN not mandatory for NRIs

NRI: The Indian government has once again extended the deadline to link Aadhaar cards with PAN numbers for Indian citizens.

Instarem integrates UPI transfers into India

Transfers made via UPI-based payments in India will now be instant, in addition to the benefits that Instarem has always offered.

NRIs are increasingly investing in Indian commercial real estate: Study

NRI millennial investors are increasingly investing in Indian commercial real estate. 53% of NRI investors are millennials, reveals the second edition of Neo-realty Survey by MYRE Capital.

How to fill Mudra loan application?

If you are running a non-farming or a non-corporate organization and looking to acquire financial assistance to make things move along swimmingly, a Mudra loan might just be your best possible bet.

Documents required for Bajaj Allianz bike insurance

Buying bike insurance is more of a necessity as it is for your safety and is already mandated by the law. Choosing a good plan is of utmost importance and far better than taking insurance just to abide by the law.

Model Tenancy Act to boost NRIs’ investment hopes in Indian rent market: ANAROCK’s Shajai Jacob

The Indian Cabinet’s recent approval for the Model Tenancy Act is being hailed as a landmark moment in Indian rent market.

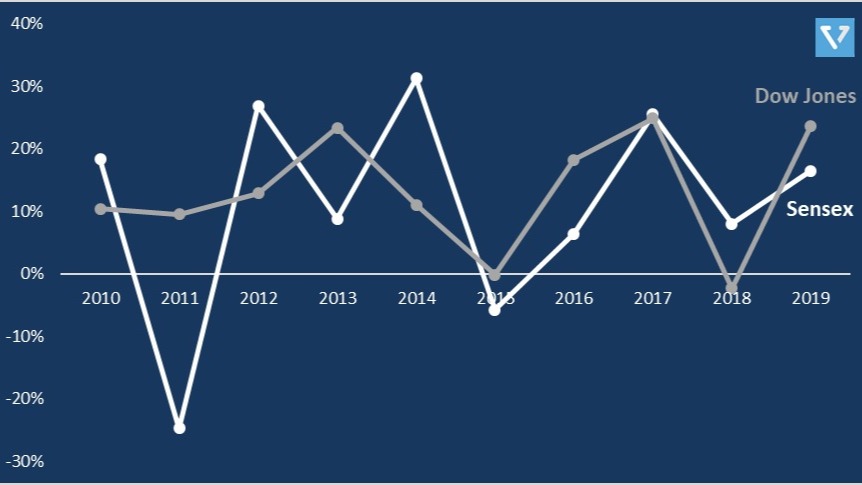

NRIs – Make sure to diversify your equity portfolios geographically

One misstep from a country’s leadership can send the entire economy, and along with it the stock market, in a downward spiral. Therefore, it is only wise to not have your investments completely dependent on one country.

NRIs, OCIs pensions to be taxed at source as per DTAA: Indian pension authority

NRI News: Pensions for Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs) will be taxed with rates set in various Double Taxation Avoidance Agreements (DTAA).

India Tax: CBDT issues clarifications which are relevant to NRIs too

Central Board of Direct Taxes (CBDT) has released clarifications in the form of frequently asked questions (FAQs) addressing some matters that are relevant to NRIs