Shrugging off concerns over the depreciation of rupee, the RBI on Friday cut interest rate by 25 basis points to 5.25 per cent in a bid to further bolster economic growth, which rose to a six-quarter high of 8.2 per cent in the second quarter of the current financial year.

The development is expected to make advances, including housing, auto and commercial loans cheaper.

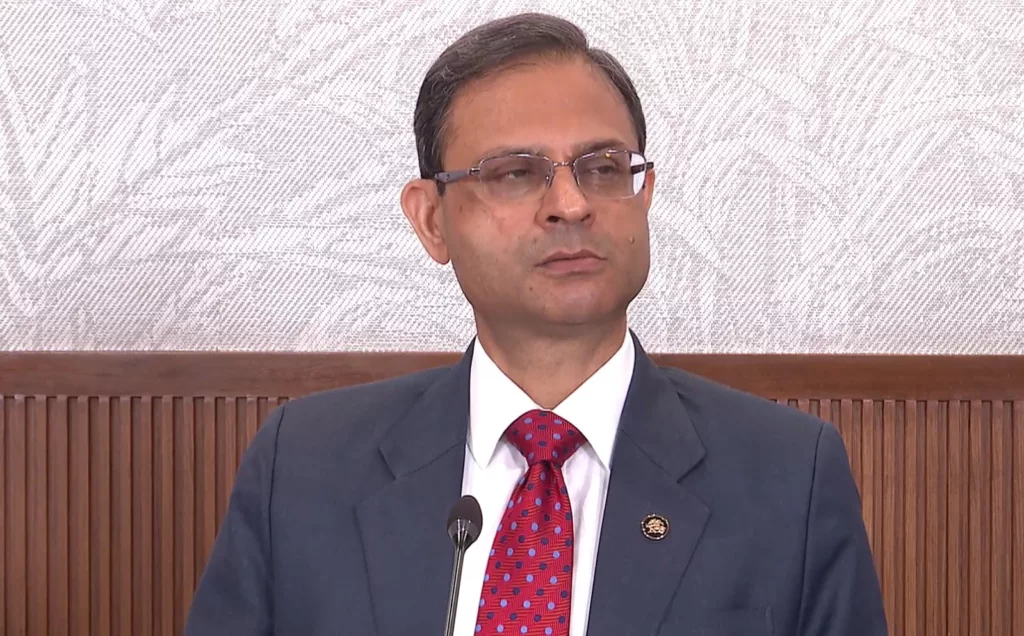

Announcing the fifth bi-monthly monetary policy for the current fiscal, RBI Governor Sanjay Malhotra said the Monetary Policy Committee (MPC) has unanimously decided to cut the short-term lending rate or repo rate by 25 basis points to 5.25 per cent with a neutral stance.

ALSO READ: India gets most foreign investment from US, Singapore: RBI data

The rate cut comes on the back of the consumer price index (CPI) based headline retail inflation ruling below the 2 per cent lower band mandated by the government for the last three months.

India’s retail inflation dropped to a historic low of 0.25 per cent in October 2025, marking the lowest level since the Consumer Price Index (CPI) series was introduced. Besides, the Indian economy has clocked better-than-expected GDP growth of 8.2 per cent in the second quarter.

ALSO READ: RBI cuts key repo rate again to boost Indian economy amid US tariffs

However, the rupee declined to historic low and crossed 90 against a dollar earlier this week making imports costlier, raising fears of rise in inflation. Rupee has depreciated by about 5 per cent so far this year.

The RBI has sharply raised growth projection to 7.3 per cent from earlier 6.8 per cent for the current financial year.

The central bank has been tasked by the government to ensure that CPI- based retail inflation remains at 4 per cent with a margin of 2 per cent on either side.

Based on the recommendation of the MPC, the RBI reduced the repo rate by 25 bps each in February and April, and 50 basis points in June amidst easing retail inflation.

The retail inflation is trending below 4 per cent since February this year. It eased to historic low in October, aided by an easing of food prices and favourable base effect.