In a first-of-its-kind collaboration between the Central Provident Fund (CPF) Board and a bank, DBS is introducing a retirement planning portal to help customers to better understand estate planning topics.

It will also provide them with access to relevant services such as CPF nomination, will writing and setting up a Lasting Power of Attorney (LPA). The two parties are also working together to train the bank’s Wealth Planning Managers and loan specialists on CPF schemes.

DBS said in a press statement that the bank is ramping up its suite of digital financial planning solutions and tools to empower Singaporeans in retirement planning and financial resilience.

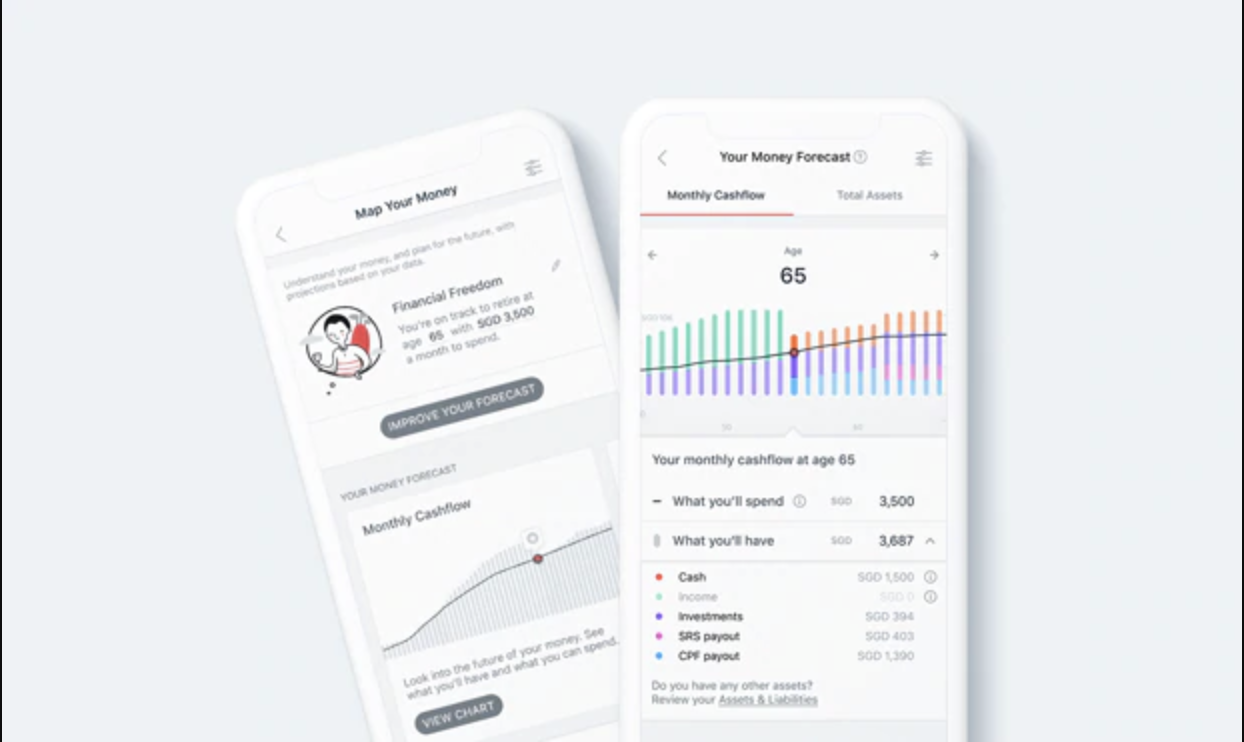

The solutions, which will be launched from this week, will also include a new “Map Your Money” interactive dashboard which can project a customer’s future retirement needs based on their current finances.

DBS’ new solutions will help customers and their Wealth Planning Managers identify and address any blind spots or gaps in their retirement planning lifecycle, whether a customer is accumulating assets or moving into the decumulation phase.

The bank noted that a third of its customers presently have negative cash flow. While most DBS customers know when they want to retire, they are less certain about how long their nest egg will last. They also do not know how to supplement their cash and CPF savings with investments.

"Coupled with our partnership with CPF, we are offering Singaporeans an industry-first holistic retirement proposition that provides greater clarity around their financial future based on the assets they have, including those held under government schemes such as CPF and the Supplementary Retirement Scheme (SRS)," said Jeremy Soo, Head, Consumer Banking Group, DBS Singapore.

"This unparalleled access to insights and resources will enable Singaporeans to make more informed investment decisions that will strengthen their financial resilience during their golden years and protect the financial health of their loved ones.”

Irene Kang, Group Director (Communications), CPF Board, added, “CPF is an important foundation of retirement for many Singaporeans. We congratulate DBS for taking the initiative to make retirement planning more accessible to everyone, and we welcome similar collaborations with other financial institutions.”