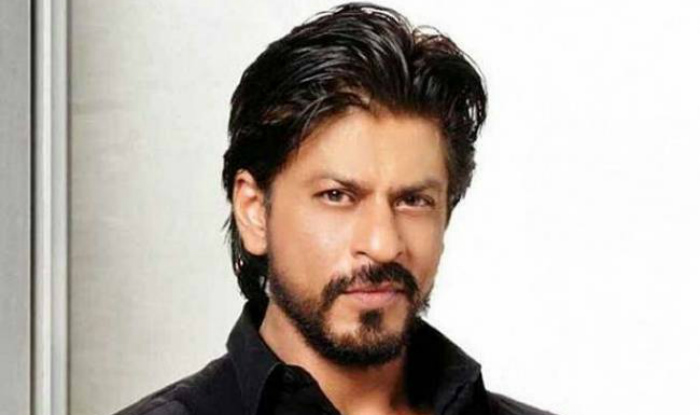

Bringing relief to Bollywood actor Shah Rukh Khan, the income-tax appellate tribunal (ITAT) of India has ruled that a villa in Dubai gifted to the superstar cannot be taxed in India. It has rejected the tax department’s contention that the villa was a camouflage to evade income tax.

The tribunal also held that the value of the villa cannot be treated as part of the actor’s taxable income.

On taxation of a gift in kind, ITAT pointed out that for the relevant financial year, gifts of immovable property made without any consideration were out of the tax ambit.

The Dubai villa was gifted to SRK under a formal gift deed in 2007, after he obtained the RBI's approval. The villa was given by Nakheel PJSC, a Dubai-based company known for the famous Palm Projects.

The contention of the income tax authorities was that the donor had gifted the villa to SRK as it was keen on using the actor’s image and brand. Shah Rukh Khan is a global actor and has endorsed various foreign brands for remuneration running into millions of rupees.

Thus, the gift was seen as remuneration to Khan for utilising his brand image and in lieu of his stage performance at the company's annual day event. As a result, I-T authorities sought to tax the value of the villa as income in Shah Rukh Khan’s hand.

I-T officials added the value of the villa – INR178.5 million – to the income of INR1.263 billion declared by Khan in his I-T return for the assessment in the financial year 2007-08. SRK would have had to pay tax on this additional income.

However, at the first stage of appeal, the commissioner (appeals), agreed with the I-T authorities. Based on a valuation report, though, he reduced the addition to INR147 crore.

Appealing before ITAT, Khan, through his counsel, said the chairman of the company, Sultan Ahmad Bin Sulayem, was his friend and thus wished to make the gift. He admitted to attending the annual day event, but said he merely addressed the employees and did not perform on stage, which would have amounted to brand endorsement.